As the clock continues to tick down to the 29 March 2019, when the UK is scheduled to officially leave the EU at 11pm, there is still much uncertainty around what Brexit will mean for UK business. (more…)

Read More

As the clock continues to tick down to the 29 March 2019, when the UK is scheduled to officially leave the EU at 11pm, there is still much uncertainty around what Brexit will mean for UK business. (more…)

Read More

Included in this article:

– HMRC error hits early-paying self-assessment taxpayers

– Minimum contributions rise to 3% for employers in April

– Making Tax Digital for VAT: one month to go

– Government launches service to prepare firms for EU exit

Thousands more landlords are being pursued by the taxman as part of a drive to catch out those investors underdeclaring property income, figures obtained by Telegraph Money have revealed.

Read More

My client has asked me about the new legislation regarding payslips that comes into effect in April 2019. Can you shed some light on this?

(more…)

My client is an online retailer, selling through Amazon and other online marketplaces. They have recently received correspondence from Amazon with regard to the online sales they make to customers in Germany. It appears that Amazon is insisting that my client must VAT register in Germany if they want to continue to sell to German customers via Amazon. Can you advise what has prompted this action?

(more…)

Now that the self-assessment filing date of 31 January has passed once again, I would like to be able to understand and explain to clients the penalty regime that will apply if their returns have not been filed on time.

(more…)

Included in this months issue:

– Auto-enrolment fines rise 146%

– Dual-registration service passes 200,000 milestone

– Partners hit by avoidable ISA tax charge

– Think tank proposes tax changes to save £7bn (more…)

From April 2019, some estates in England and Wales could be required to pay almost £6,000 for a service that currently costs less than 4% of that amount.

This is because of a proposed change to the fees families must pay to administer the estate of someone who has died. (more…)

Read MoreIt’s a fact – humans are bad at assessing risk. We’re terrified of things that rarely happen (plane crashes, power station meltdowns) but relatively blasé about things that are statistically more likely to harm us, such as unwashed lettuce.

The likelihood of HMRC swooping to investigate your business’s tax affairs seems to be a particularly difficult risk to quantify. (more…)

Read More

My client and her husband run a boutique hotel in partnership. Due to the location and quirky nature of the décor, they are increasingly getting requests to host celebrations and parties in addition to overnight accommodation. As the financial outlay in preparing and staging the events can be quite considerable, the client asks for a 25% deposit up-front, which is non-refundable if the event is cancelled. Please, could you advise on the VAT treatment and time of supply implications of these deposit payments? (more…)

Read More

How do the new company car tax bands favour ultra-low emission vehicles (ULEVs)?

(more…)

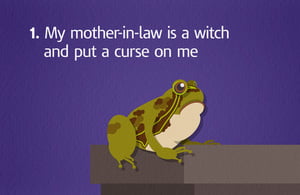

As the deadline approaches for submitting returns and paying tax for 2017 to 2018, HMRC reveals some of the most bizarre excuses it has received for not paying on time.

Read More

Included in this months article:

– Businesses getting to grips with apprenticeship levy

– R&D investment grows to £23.7bn in 2016/17

– OTS calls for inheritance tax system to be digitised

– Critics urge delay in rollout of MTD

National insurance contributions (NICs) are set aside to pay the state pension and other benefits, but due to the UK’s ageing population the National Insurance Fund is under increasing strain, with the state pension taking up more than 90% of its annual outlay in 2018.

Read More

Does it make sense for your business?

Around 1.4 million businesses in the UK employed members of staff in 2018, and all of them shared one thing in common: the legal requirement to run payroll.

Read More

My client has been approached by a builder, who carried out repair work to the client’s factory some years ago. The builder was late registering for VAT and is now looking to issue VAT only invoices to my client for the supplies in question. I have several concerns: is the supplier liable to account for the VAT if the supplies were made more than 4 years ago? Is my client obliged to pay and if so can he now recover the VAT given that the original invoices were dated more than 4 years ago?

(more…)

Jack and Jill jointly own two investment properties and wish to swap their interests so that they each have ownership of one of the properties. As tenants in common they currently equally own Cornfield with a market value of £210,000 and the original cost of £50,000 and Wheatfield with a market value of £200,000 and the original cost of £49,000. Jack is to have Cornfield and Jill is to have Wheatfield. What are the CGT and SDLT implications?

(more…)

My client has asked me if they need to update their modern slavery statement this month. Is this something they need to do? (more…)

Read More

This months edition includes:

– Stamp duty tax break saves first-time buyers £284m

– HMRC confirms ‘soft landing’ for Making Tax Digital

– Inheritance tax receipts reach record high of £5.2bn

– SMEs cite VAT as ‘biggest administrative headache’

If there’s one thing that keeps us awake at night it’s the thought of how many British businesses are failing to claim capital allowances to which they are entitled – worth billions of pounds across the board, according to some estimates.

Capital allowances provide the mechanism for tax relief on certain types of capital expenditure (the purchase of assets such as office furniture, or equipment) essentially providing a deduction against profits. (more…)

Read More

First-time buyers in England, Northern Ireland – and for a short time in Wales – were the biggest winners in the most recent shake-up to affect property taxes in Autumn Budget 2017.

Philip Hammond’s headline measure was to abolish stamp duty for first-time buyers on homes worth up to £300,000, and the chancellor didn’t stop there. (more…)

Read More

Is tax relief available for training costs when setting up a new trade in a limited company?

(more…)

My client has heard about upcoming changes to the Childcare Voucher Scheme. They currently offer this scheme to their staff so will they need to make any changes? (more…)

Read More

I have a client who is carrying out extensive building modifications to a disabled person’s home. He has had conflicting advice from various contacts in the trade about VAT. Can all the work be zero-rated or are there limitations?

(more…)

HM Revenue and Customs (HMRC) announced its new Making Tax Digital (MTD) in the March 2015 Budget but since then, there have been many consultations and changes in the implementation dates. The aim is for HMRC to be interacting digitally with all taxpayers.

(more…)

We have an employee who is being made redundant and is entitled to Statutory Maternity Pay (SMP). Do we have to continue paying SMP after the redundancy?

(more…)

My client has a member of staff with long-established care responsibilities and wants to know how they can support the individual?

(more…)

My client, a small owner-managed company, purchased five-year-old freehold premises to trade from in June 2017. The total cost of the premises and refurbishment was 180K + VAT, which the company reclaimed in full in the 06/17 period, and the company has occupied it since for its engineering business. The business has always been fully taxable.

(more…)

My client purchased their buy to let property using an Islamic finance Murabaha arrangement. As the provider cannot charge interest does this mean that my client can’t claim any of these finance costs against their rental property income?

(more…)

My clients are a farming company. They recently disposed of a large piece of fixed machinery used in the business for £60,000, and made a capital gain of £10,000. The actual sale proceeds were used to fund salaries and pension contributions in the month of disposal but six months later, after the company obtained further funding, they spent £100,000 on a qualifying replacement asset, a more modern equivalent of the old one. Is it still possible to rollover the gain in these circumstances, given that the sale proceeds of the old asset were not directly used to obtain the new one?

(more…)

My client frequently has to stay in hotels for business. The hotel takes a deposit at the time of booking with the balance of the cost paid over when the stay takes place. Sometimes my client’s plans, or those of his customer, change and he cancels the booking and the hotel keeps the deposit paid. Some hotels send a VAT invoice covering the amount of the deposit they retain after the cancellation and some say that they cannot issue a VAT invoice because VAT is not applicable to the amount they have retained. Which is correct for VAT purposes? (more…)

Read More

My client has recently enquired about the possibility of claiming relief for the expenses of cleaning of clothing that she wears in her role in nightclub security, having heard that there are flat rate expenses that employees are able to claim.

(more…)

This months edition includes:

– Landlords welcome tax incentives for long-term tenancies

– Contractors criticise ‘flawed’ IR35 test

– ‘Tax over-40s to pay for elderly care costs’, say MPs

– BCC calls for further delay to digital accounts rollout

Millions of married couples and civil partners in the UK are eligible for the marriage allowance, but take-up has remained subdued since the tax break came into force on 6 April 2015.

Almost half of the UK’s eligible couples failed to claim their slice of £1.3 billion in marriage allowance cash in 2016/17, with many couples either unaware of the tax break or forgetting to claim it. (more…)

Read More

Whether you’re a buy-to-let landlord, a shareholder, an art dealer or you fall somewhere in between, the chances are you will be familiar with paying capital gains tax (CGT).

CGT is payable when you ‘dispose’ of a certain item and make money from the sale, with the amount you’re liable for depending on your income and the asset in question. (more…)

Read More

The pros and cons of letting furnished holiday accommodation.

When furnished holiday property is let on a commercial basis for short periods, the owner can benefit from tax reliefs which wouldn’t otherwise be available to residential landlords, providing certain conditions are met.

However, there are also several disadvantages associated with letting property as holiday accommodation whether or not the furnished holiday letting conditions are met.

Read More

Obligations from 1 April 2019 onwards.

Although the Making Tax Digital (MTD) regime has suffered several setbacks and delays, MTD for VAT remains on course to take effect from its planned implementation date of 1 April 2019.

Under the scheme, VAT-registered businesses are required to maintain digital records, complete the VAT return from the digital records and send it electronically to HMRC.

Read More

This months edition includes:

– ‘Raise the VAT threshold to stimulate SME growth’

– SMEs miss out on business savings interest

– Calls increase for reform of ‘flawed’ apprenticeship levy

– Working pensioners pay £8.6bn in income tax

My client is a landscape gardener and has recently purchased a Nissan Navara double cab vehicle to use for his work. There will be some private use as well as business use. I had thought this might qualify as a commercial vehicle rather than a car, although I am feeling a little uncertain as the vehicle does have… (more…)

Read More

I understand that Class 2 NIC is finally being abolished from 6 April 2019. This means that those of my self-employed client with losses or low profits who want to protect their state pension contribution record will have to pay Class 3 contributions which are considerably more expensive. Will there be any alternatives? (more…)

Read More

Read MoreA client has told me a female employee has failed to wear high heeled shoes or makeup to work several times this week in line with their dress code policy. What should they do about this?”

IMPORTANT: We’re aware of a new email scam targeting employers. If you receive an email about P6/P6T forms with an attachment, please forward to phishing@hmrc.gsi.gov.uk.

This email is a scam and the attachment may contain malicious software. Please share this post to warn others.

Read More

This months edition includes:

– Tenant fees ban set to cost landlords £82.9m

– Businesses call for more government support

– HMRC defers launch of digital accounts for individuals

– Deadline for reporting benefits in kind nears

IR35 is the shorthand name for tax rules concerning the provision of personal services through intermediaries.

These rules came into effect on 6 April 2000, but they were signiicantly amended from 6 April 2017 for contracts involving public sector bodies. (more…)

Many employees need to travel as part of their job for various reasons, whether it’s acquiring new customers, working with current ones or attending conferences and events.

The system of benefits and taxation surrounding this essential economic activity is classed as ‘travel and subsistence’ in the eyes of the taxman. (more…)

The company provides some employees with Company cars that are hybrids. The employees are also provided with fuel cards that are available for their private use and receive a fuel Benefit in Kind in relation to the car. However, the cars are plugged in and charged at home can the employer offset this cost against the fuel Benefit in Kind?… (more…)

Read More

For most businesses input tax recovery on the purchase of a car is blocked; there are however a few exceptions. (more…)

Read More

Hopefully you should all have now received the tax packs we sent earlier this month and an invitation to complete your checklist online at our website. Remember you also need to complete the tax return supplementary questionnaire online (Click Here). This replaces the paper ones we used to send – reception will send you a paper copy if you prefer. (more…)

Read More