Included in this month’s article:

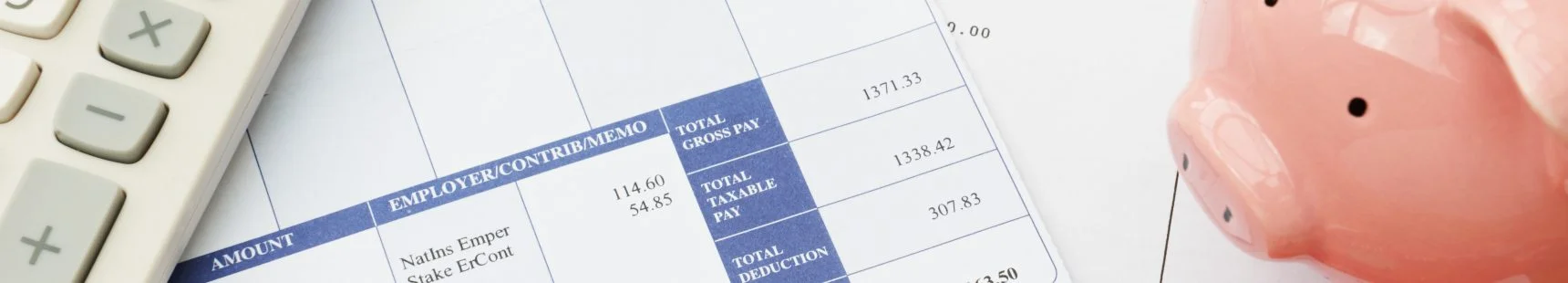

- HMRC waives penalties again for late self-assessment

- Omicron-hit employers can reclaim statutory sick pay

- Treasury’s pensions tax relief bill soars past £42BN

- Deadline looms for new hospitality and leisure grants

Included in this month’s article:

Inheritance tax was thought to be ripe for reform in last year’s Autumn Budget but, as it happened, it was left untouched for another tax year.

(more…) Read More

Tax-efficient advice for limited company directors.

Believe it or not, there are more than 4.7 million limited companies registered in the UK, including the 810,316 incorporations that signed up in 2020/21.

(more…) Read More

Included in this months issue:

Making Tax Digital for income tax (MTD for ITSA) looks certain to affect sole traders and landlords from April 2024, following the recent news of a one-year delay.

This was the latest in a long line of delays and deferrals in the rollout of MTD, which was first proposed by then-Chancellor George Osborne in late 2015.

(more…) Read More

Included in this month’s article:

Included in this months article:

For most UK citizens, the question of what income and gains should be included on their tax return is easily answered because they are both UK domiciled and UK tax resident.

Anyone domiciled and resident in the UK will need to report their worldwide income and capital gains on their return. However, what happens if you are either non-UK domiciled (non-dom) but UK resident, or UK domiciled but non-UK resident?

(more…) Read More

A chunk of time has passed since the self-employed income support scheme (SEISS) was launched in May 2020, following the onset of the COVID-19 pandemic.

The first taxable grant, worth up to £7,500 in total, was paid out in August 2020. That was followed by a second grant of up to a total of £6,570 and a third grant, worth up to £7,500 in total.

(more…) Read More

Included in this month’s article:

Unincorporated businesses could be about to see significant changes to the ways in which they are taxed, following the launch of a Government consultation.

The Government plans to reform the basis period rules in a bid to simplify how unincorporated businesses, such as sole traders and business partnerships, allocate trading profits to tax years for inclusion on their self-assessment returns.

(more…) Read More

Included in this month’s article:

Included in this month’s article:

After a challenging year for the UK’s residential landlords, you might have read about improvements to the buy-to-let mortgage market in recent weeks.

In the three months to 31 May 2021, the average interest rates for residential landlords had declined. A two-year fixed-rate buy-to-let mortgage fell 0.10 percentage points to 2.95%, while a five-year fixed dropped 0.11 percentage points to 3.30%.

(more…) Read More

Included in this months article:

The way that most self-employed taxpayers report their business profits to HMRC is set to change in April 2023 under the Making Tax Digital (MTD) for business regime. The changes to date have applied only to businesses that are VAT registered.

(more…) Read More

Included in this month’s article:

Owning and letting out a holiday home, otherwise known as a furnished holiday let (FHL), has always been a popular way of investing and earning income.

Not only do FHLs enjoy many tax advantages over normal residential let properties, owners have an asset which they can use for holidays while it largely pays for itself.

(more…) Read More

Included in this month’s article:

Tax Card 2021/22

(more…) Read More

For the past 40 years or so, corporate tax rates have decreased steadily around the world. In 1980, the global average stood at around 40%, but by the end of 2020 it was closer to 24% as various countries aimed to encourage business investment.

(more…) Read More

If there’s one thing to take away from Spring Budget 2021, it’s taking charge of your personal finances is going to be increasingly important over the next five years.

(more…) Read More

Included in this month’s article:

Included in this month’s artice:

It’s not often that HMRC makes exceptions to its tax deadlines or late-filing penalties, but the past year has, as in so many ways, been different.

Between optional deadline deferrals, new payment schemes and temporary reliefs, keeping on top of the changes to the usual tax timetable hasn’t been easy.

(more…) Read More

Included in this months article:

My client has had a computation from HMRC for the CIS (Construction Industry Scheme) deductions they failed to deduct from payments made to a subcontractor for the current and last 6 tax years.

What about the tax paid by the subcontractor on this income via Self Assessment/Corporation Tax? Can this be taken into account?

With the ever-changing circumstances of 2020/21 it is hard to imagine that we are already close to the tax year end again.

Feels like we did nothing and went nowhere in the last 12 months!

(more…) Read More

I am selling a Furnished Holiday Letting and understand I can rollover the gain into another qualifying letting property. However, I am not anticipating buying a new property for a year or so. In the meantime do I still have to make a return under the 30 day reporting scheme and pay the capital gains tax?

(more…) Read More

Included in this month’s article:

I have a number of clients based in Northern Ireland (NI) who both supply goods to and buy from mainland UK and the Republic of Ireland (ROI) mainly on a wholesale basis. Please could you clarify the rules post-Brexit.

(more…) Read More

My client has been in dispute regarding a road traffic accident between one of his company’s lorries, and another VAT registered business’ lorry. A small claims court has judged in favour of the third-party business, and has awarded them payment for damages, including reimbursement of their legal costs. The third-party is a partially exempt business, and so they would like reimbursement for the net amount of their costs, plus the VAT – will the third party raise a VAT invoice to us for payment of those costs and can my client claim back any of the VAT?

(more…) Read More

INCLUDED IN THIS MONTH’S ARTICLE:

INCLUDED IN THIS MONTH’S ARTICLE:

– GROUP SLAMS LATEST TAXABLE GRANTS FOR THE SELF-EMPLOYED

– IMPROVED JOB SUPPORT SCHEME OPENS FOR EMPLOYERS

– SUNAK HINTS AT SPRING TAX HIKES TO ‘BALANCE THE BOOKS’

– THREE IN FIVE BOUNCE-BACK LOANS MAY NEVER BE REPAID, WATCHDOG CLAIMS

If you are considering moving home in the second half of 2020/21, you are by no means alone.

In the month leading up to 8 August 2020, 149,000 properties were put on the market – the highest number since before the financial crash in 2008.

Included in this month’s article:

INCLUDED IN THIS MONTH’S ARTICLE:

With everything that’s happened so far this year, it might be easy to forget your obligations to file a tax return for 2019/20 by midnight on 31 January 2021.

The coronavirus pandemic and subsequent economic crisis has caused chaos with businesses up and down the country, most of which closed entirely during April 2020.

Several years ago I separated from my wife but the divorce has now gone through. I still own half of the marital home but I have been living in rented accommodation since the separation. Can I claim that my old marital home is still my main residence for capital gains tax purposes when it is sold?

I intend to remarry and my girlfriend wants to give me a share of her current home after we are married. Apparently this was let for a time before my girlfriend made it her home. Would there be any capital gains tax advantage in doing this?

(more…) Read More

Even among those who follow good tax-planning practice and maintain forecasts running several years forward, it is unlikely that many foresaw the dramatic end to the 2019/20 tax year.

With the arrival of COVID-19 and the subsequent lockdown, the economy shrank a record 20.4% in April 2020, and 19.1% in the three months to May 2020.

(more…) Read More

INCLUDED IN THIS MONTHS ARTICLE:

Offering a company car as a benefit can be a valuable and attractive perk to any valued employee.

Unfortunately, it is not necessarily a tax-free perk and it may be liable for PAYE because HMRC considers the private use of a company car to be a benefit-in-kind.

(more…) Read More

Coronavirus has many people reflecting on their own mortality. So if you have more time on your hands during the lockdown, planning your estate may be a wise way to spend it.

(more…) Read More

Included in this month’s article:

After temporarily pausing tax investigations as COVID-19

business support measures rolled out earlier this year, HMRC

has restarted probes into businesses and individuals’ tax affairs.

The Revenue has also started to direct its attention towards the

misuse of coronavirus support schemes, such as the furlough

scheme and the self-employed income support scheme.

There are many ways to reduce or eliminate the inheritance tax

payable on your estate without using trusts.

But for some, especially if you are very wealthy, they may not be

enough. For others, the control that trusts give over who benefits

from your wealth, and how, is vital for estate planning.

Included in this month’s issue:

INCLUDED IN THIS ARTICLE:

– COVID-19 POSTPONES OFF-PAYROLL EXTENSION TO THE PRIVATE SECTOR

– CORONAVIRUS PANDEMIC PROMPTS ONE-YEAR BUSINESS RATES HOLIDAY

– CHANCELLOR UPS ANNUAL PENSION ALLOWANCE THRESHOLDS BY £90,000

– ENTREPRENEURS’ RELIEF LIFETIME LIMIT SLASHED FROM £10M TO £1M

The last few months of the tax year are the ideal time to pause and reflect, and to make sure you’ve organised your finances as efficiently as possible before the new tax year begins on 6 April 2020.

(more…) Read More

Many of my small company clients often have overdrawn director loan accounts. When considering minimising the beneficial loan charge, what interest can be taken into account to reduce or cancel the benefit charge?

(more…) Read More