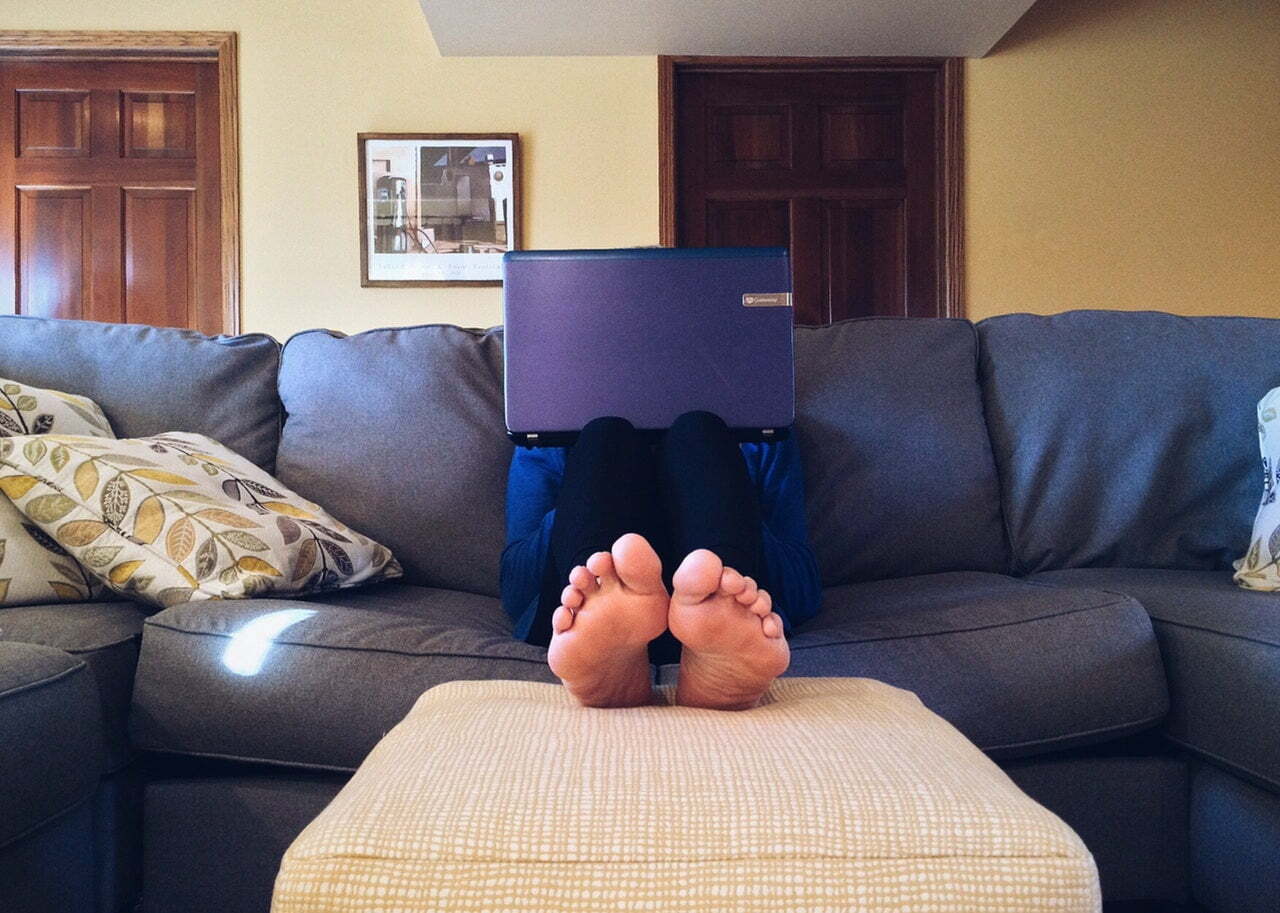

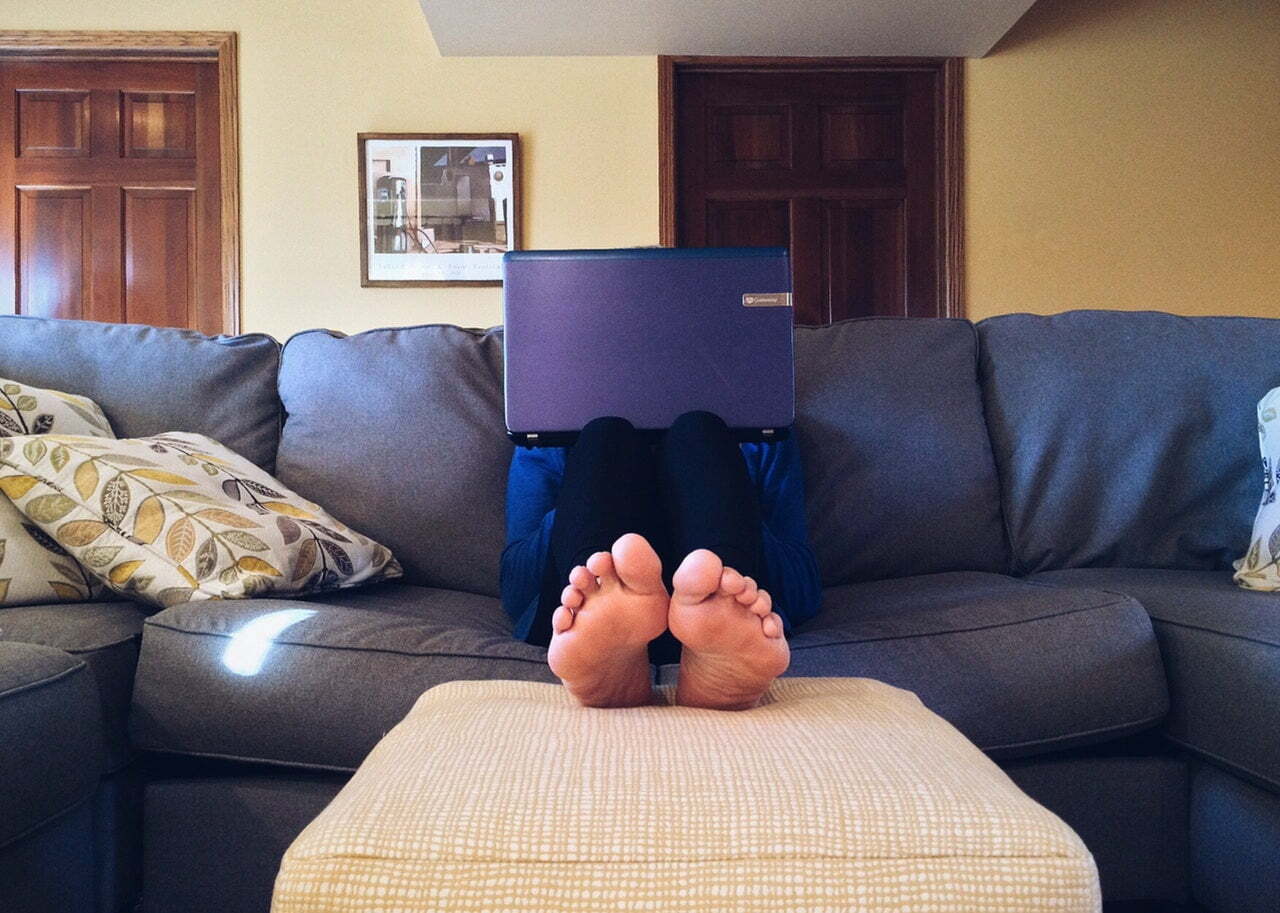

Working from home offers all kinds of benefits, from the opportunity to create the perfect environment in which you can be most productive, to the improvements to work-life balance that come with ditching the commute. (more…)

Read More

Working from home offers all kinds of benefits, from the opportunity to create the perfect environment in which you can be most productive, to the improvements to work-life balance that come with ditching the commute. (more…)

Read More

When you supply goods and services, you expect to be paid, and promptly, but Britain has a deeply embedded culture of late payments. Indeed, for some businesses, delaying payment is an essential part of the business model. (more…)

Read More

Digital record keeping requirements: Treatment of supplier statements or individual invoices

The Croner Taxwise VAT Advice line has received numerous calls from accountants whose clients receive large numbers of invoices from single suppliers, such as builder’s merchants or drugs companies. (more…)

Read More

My client is a small independent retailer selling mobile phones and accessories, with turnover below the VAT registration threshold. Last year, in September 2018, they bought the premises they were occupying from their landlord. The landlord had opted to tax and the purchase price was £100,000 plus VAT. In order to recover the VAT, the client VAT registered and notified their own option to tax. The client’s turnover has remained below the threshold, and they have asked me whether they can deregister, and what the consequences of that would be.

(more…)

My client owns a joint share in the freehold of a building which consists of five flats. One of the flats is occupied by my client under a 999-year lease.

The freeholders are to grant a new long lease over another flat in the building. My client understands that this will be a capital gains disposal event, but has queried whether a measure of principal private residence relief would be due to him, given that the disposal is out of the freehold interest he owns that includes his main residence.

Can you please confirm how to approach my client’s capital gains position, whether any main residence relief would be due to him in these circumstances and how this would be calculated? (more…)

Read More

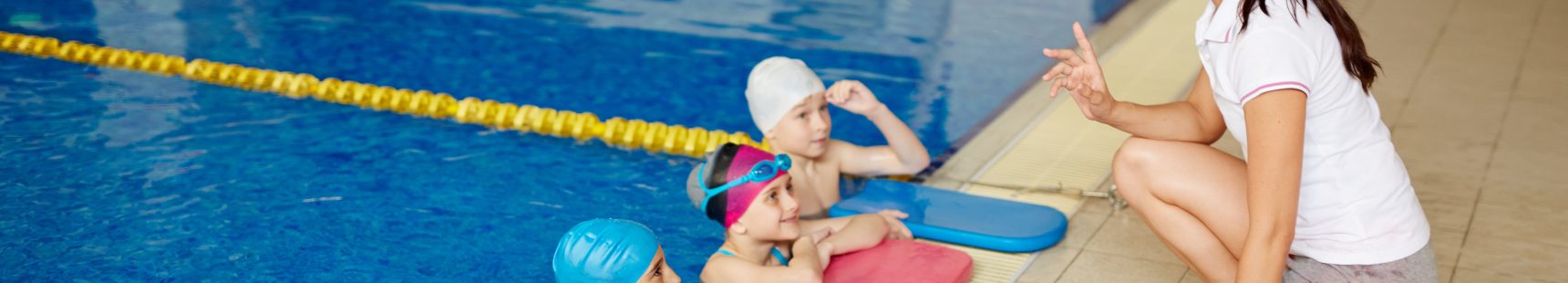

My client is a Limited Company and runs a swim school, teaching children. The client’s turnover is close to £85,000. I would like to confirm that my client is making exempt supplies of education and therefore does not need to VAT register.

(more…)

My clients have inquired about the possibility of claiming relief for expenses incurred in connection with closing down their company. In particular, they would like to know whether they could get tax relief for professional advice that they have taken and whether they can arrange for the company to make pension contributions on behalf of employees.

(more…)

My client has been informed by an employee that they have been summoned to attend jury service, what are the rules around this?

(more…)

My employer has heard of a new combined life policy which also covers critical illnesses and claims that there is no taxable benefit on the premiums. Is this correct?

(more…)

My client is the director of an interior design company. The company rents a small unit for storing stock, but this space is not really suitable for use as an office. She is exploring the possibility of having a home-office erected in her garden. Could you please advise on the VAT recoverability of such a project?

(more…)

My client is about to register for VAT and wants to use the flat rate scheme as she meets the conditions and it would be beneficial to her. However, her intention is to register for normal VAT initially, in order to recover pre-registration input tax, and then after the first return has been filed, switch to the flat rate scheme. Is this acceptable or will HMRC challenge it?

(more…)